Financial data is vast and complex, making it difficult for businesses to extract meaningful insights from regulatory reports, digital transactions, and market trends. Topic modeling is an unsupervised machine-learning technique that identifies patterns and themes within large text datasets. Instead of manually analyzing reports, analysts use topic modeling to uncover risks, trends, and insights from financial documents, market news, and customer feedback.

With this technology, banks and other financial institutions analyze earnings call transcripts, legal filings, and economic reports at scale, allowing for quicker decision-making. From fraud detection to risk management, topic modeling is transforming financial data analysis by automating core processes.

Understanding Topic Modeling

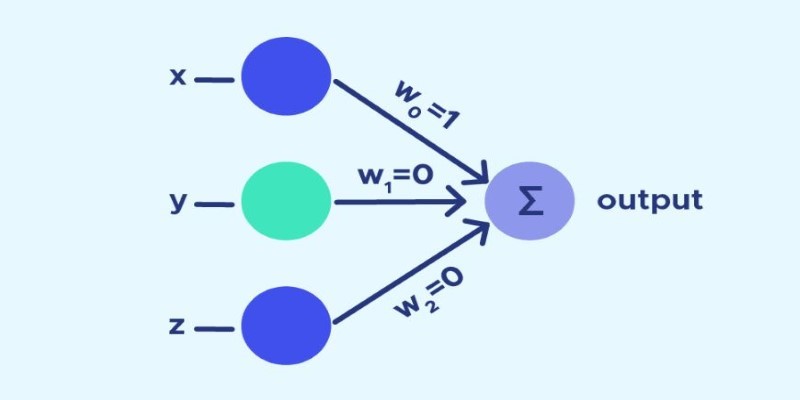

At its core, topic modeling is a method for extracting latent topics from a set of documents. It applies probabilistic methods to aggregate words that tend to co-occur and create meaningful topics in the context provided. For example, in financial markets, the words "interest rates," "inflation," and "monetary policy" tend to co-occur. A topic modeling algorithm would identify such a pattern and label it as a macroeconomic topic.

The two most prevalent topic modeling algorithms are Latent Dirichlet Allocation (LDA) and Non-Negative Matrix Factorization (NMF). LDA models each document as a combination of topics and each topic as a combination of words, with each given a probability. NMF, however, uses matrix decomposition, separating the data into interpretable patterns. Both techniques have extensive applications in finance for processing reports, news stories, and consumer reviews.

In financial data analysis, topic modeling assists organizations in extracting relevant insights from filings, earnings calls, and market discussions. Banks and investment firms utilize it to manage risks, discover fraud, and foresee market trends based on analyzing mood across a group of data feeds.

Applications in Financial Data Analysis

Financial markets fluctuate in response to news, reports, and the sentiment of investors. Topic modeling offers a means of handling this information systematically. This is how it serves an important purpose in finance:

Risk Management and Fraud Detection

Banks and regulators handle vast compliance documents, making risk detection challenging. Topic modeling scans regulatory reports, audit logs, and financial statements to identify emerging risks. It also detects fraud by recognizing unusual transaction patterns and customer complaints. By automating risk assessment, financial institutions can enhance security and prevent fraudulent activities before they escalate.

Market Trend Analysis

Understanding financial trends requires analyzing massive datasets, including news, reports, and investor discussions. Topic modeling clusters related terms, helping analysts detect early economic signals. For example, a growing emphasis on "inflation concerns" in central bank reports could indicate impending interest rate hikes. This proactive approach enables institutions to adjust investment strategies and manage risks effectively.

Customer Sentiment Analysis

Financial institutions rely on customer sentiment to refine services. Topic modeling analyzes reviews, support queries, and social media feedback to identify trends in customer satisfaction. If complaints about specific banking services surge, institutions can address issues before they damage reputations. This technique provides real-time insights, allowing firms to enhance user experience and maintain customer trust.

Automating Financial Report Analysis

Reading financial statements, regulatory filings, and earnings call transcripts is labor-intensive. Topic modeling automates this process, summarizing key topics to help analysts extract critical insights faster. Investment firms use it to track recurring themes in earnings reports, enabling them to make informed decisions. By reducing manual effort, financial analysts can focus on deeper data-driven strategies.

Challenges and Limitations of Topic Modeling in Finance

While topic modeling is a powerful tool in financial data analysis, it faces several challenges. One of the biggest issues is accuracy. Financial language is highly specialized, filled with jargon, complex terminologies, and evolving trends. Traditional algorithms like LDA often struggle to capture these nuances, leading to ambiguous or irrelevant topic groupings. As a result, manual fine-tuning is often required to improve the model’s precision.

Another limitation is interpretability. Topic modeling identifies word clusters, but understanding their meaning depends on human judgment. A cluster containing terms like "liquidity," "market crash," and "interest rates" might indicate economic downturns, but without proper context, its relevance remains uncertain. Analysts must carefully evaluate the outputs to ensure meaningful insights.

The effectiveness of topic modeling also depends on data quality. Poorly structured or biased datasets can lead to misleading patterns, which could negatively impact financial decision-making. Since markets demand accuracy, incorrect topic associations may result in flawed risk assessments or investment strategies. Despite these challenges, integrating advanced AI models, hybrid approaches, and deep learning techniques can enhance the precision and applicability of topic modeling in finance.

The Future of Topic Modeling in Finance

As artificial intelligence continues to evolve, topic modeling is becoming more advanced. Traditional models like LDA are now being enhanced with deep learning approaches, improving accuracy and contextual understanding. Transformer-based models, such as BERT and GPT, are pushing topic modeling into new frontiers, allowing financial analysts to gain deeper insights from unstructured text.

Regulatory compliance is another area where topic modeling will see significant growth. As governments introduce stricter reporting standards, financial firms must analyze and categorize compliance documents efficiently. Topic modeling will become an integral tool in navigating complex regulatory environments.

In the future, topic modeling may be combined with real-time financial monitoring, allowing firms to react instantly to emerging risks and opportunities. Automated trading strategies may incorporate topic-based signals, leveraging financial news and earnings reports to refine investment decisions.

Conclusion

Financial data analysis is becoming increasingly complex, and traditional methods struggle to process the vast volume of unstructured text. Topic modeling offers a scalable, automated solution to extract insights from reports, transactions, and market discussions. By identifying trends, detecting risks, and streamlining document analysis, it enhances financial decision-making. With advancements in machine learning, topic modeling is evolving to provide deeper insights and greater accuracy. From fraud detection to market analysis and customer sentiment tracking, financial institutions must leverage this technology to stay competitive. Embracing topic modeling ensures businesses remain agile in an industry where data drives success.